Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

Our top story today is an exclusive on the “debanking” review held by the chief UK financial regulator. The probe has uncovered no evidence that politicians are being denied bank accounts because of their views, according to people briefed on the findings.

The Financial Conduct Authority launched the probe in August, weeks after former UK Independence party leader Nigel Farage unleashed a debate on free speech by claiming his accounts with private bank Coutts were about to be closed because his views “did not align” with the lender.

The row over the “debanking” of Farage sparked complaints from other politicians about their treatment by lenders, prompting the government to order a review by the FCA.

People familiar with the situation said the FCA would publish findings in the coming days showing there were no cases of political views being the “primary” reason for personal account closures across the 34 banks and payment companies that were asked to submit data to the regulator. The FCA declined to comment. Here are more details on the findings, including Farage’s response.

And here’s more news from the UK:

Here’s what else I’m keeping tabs on today:

-

United Nations: The General Assembly convenes with speeches expected from US president Joe Biden and Ukraine’s Volodymyr Zelenskyy. The organisation’s relevance is being questioned as major leaders skip the annual event.

-

Starmer in Paris: The UK opposition leader will discuss relations with the EU when he meets French president Emmanuel Macron.

-

Economic data: The OECD publishes its Interim Economic Outlook report, and the EU has its consumer price index for last month.

-

UK strikes: The health secretary has announced that doctors and nurses in England could be forced to work during strikes, as consultants begin new industrial action today ahead of strikes by junior doctors tomorrow.

Join the Financial Times’ Growing for Good series for an exclusive discussion in Brussels tomorrow on how to navigate challenges for the food industry that have arisen from the EU Green Deal. Register for the in-person event here.

Five more top stories

1. Justin Trudeau says India may have been involved in the fatal shooting of a Sikh leader in Canada, citing intelligence from national security services. The prime minister said authorities had been “actively pursuing credible allegations”, while the country’s foreign minister said a top Indian diplomat was expelled from Canada yesterday. India’s foreign ministry has denied the allegations. Read the full story.

2. Nasdaq has inched further ahead of the New York Stock Exchange in their closest fight for listings in five years. The upcoming initial public offering of online grocery delivery company Instacart, less than a week after chip designer Arm’s $5bn listing, brings the total amount Nasdaq has raised this year to $9.3bn, compared with $8bn for NYSE. Read the FT’s analysis here.

3. Exclusive: SoftBank is leading a $280mn funding round in Mapbox, which produces the software behind the in-car navigation systems of Toyota, BMW and General Motors. The San Francisco-based company was among the earliest group of companies backed by SoftBank’s Vision Fund. Leo Lewis has the details on the Japanese conglomerate’s latest move.

4. GCHQ’s former head will chair the advisory board of Gallos Technologies, a UK venture group with close ties to the British security services. Sir Jeremy Fleming, who left Britain’s cyber intelligence spy agency in May, joins former security officials Sir Anthony Finkelstein and Tom Hurd among the company’s advisers. Read more on the latest example of the revolving door between government and industry.

5. US financial watchdogs are pushing ahead with a crackdown on deceptive fund names, despite industry warnings that it will discourage stock picking, violate free speech protections and force funds to sell assets at a loss when markets are volatile. The overhaul would require funds to prove that 80 per cent of their holdings match their names.

-

Hedge funds: A build-up of leveraged bets has the potential to “dislocate” trading in the $25tn US Treasuries market, said the umbrella group for central banks.

The Big Read

The recent Microsoft/Activision saga has pointed to the UK competition regulator’s newfound clout on the global regulatory stage and raised questions about its decision-making. Critics say the Competition and Markets Authority is taking big swings as it works out its place in the world, but supporters say its more resolute stance on policing large takeovers comes at a time when competition authorities in the US are also adopting a more assertive approach.

We’re also reading . . .

-

Starmer’s pledge: The Labour leader has promised to get a “much better” Brexit deal for the UK if he wins next year’s election. But how much can he actually do?

-

Car rivalry: German carmakers popular with Chinese consumers are worried that the EU’s subsidies probe against Beijing will unleash punitive measures and benefit French rivals.

-

Leaving bad jobs: Giving workers more security over predictable schedules and employment rights will make the labour market more flexible, not less, writes Sarah O’Connor.

Chart of the day

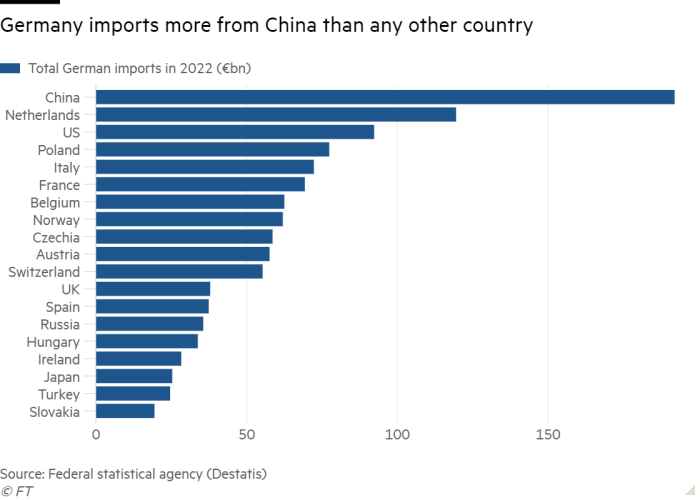

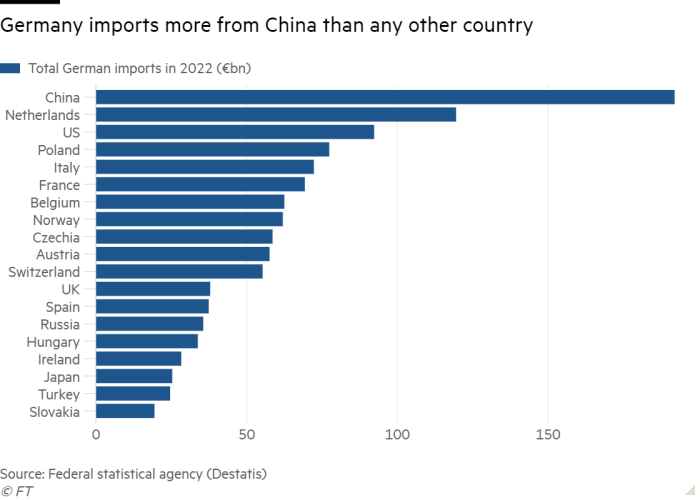

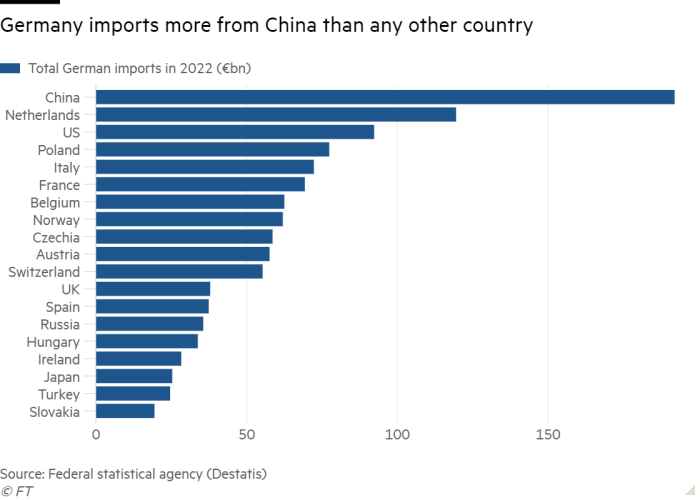

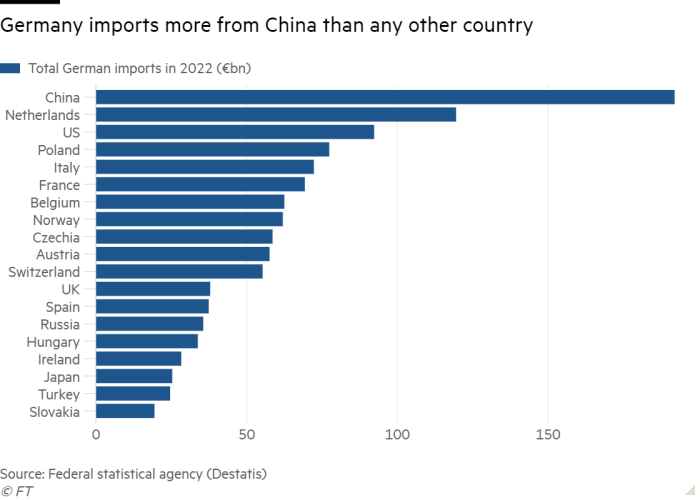

Germany’s central bank warned companies on Monday to reduce their dependence on China. The Bundesbank said 29 per cent of German companies imported essential materials and parts from China, exposing their operations to “significant” damage if this trade route were to be disrupted as a result of “increasing geopolitical tensions”.

Take a break from the news

Iranians have found few reasons to rejoice of late, with the economy on its knees and their country under international sanctions. The arrival of superstar footballer Cristiano Ronaldo, whose Saudi club plays in Tehran this evening, has provided moments of excitement and humour, though his visit has not been without controversy.

Additional contributions from Benjamin Wilhelm and Gordon Smith

This post was originally published on this site be sure to check out more of their content.