Authorities detained some staff of the money management business of China Evergrande Group, a sign that the saga around the defaulted developer at the heart of the nation’s property crisis has entered a new phase involving the criminal justice system.

The company’s shares plunged as much as 25% after trading opened in Hong Kong, before paring its loss to 1.6% at close. The stock extended this year’s decline to 63%.

Police in the southern city of Shenzhen said in a statement on Saturday that they had “recently” detained staff, identifying one of the detainees by the last name Du. No charges were disclosed and the statement didn’t say how many people were in custody. Police called on investors to provide leads to the authorities, including filing complaints online.

China Provides Assurances that Evergrande Crisis Is Being Contained

Evergrande Financial Wealth Management Co., based in Shenzhen, is a wholly owned Evergrande unit established in 2015. The firm’s general manager is Du Liang, according to his Linkedin profile. Bloomberg News wasn’t able to verify that he is among the detainees.

Evergrande sits at the center of a credit crisis that has rippled through China’s real estate sector and curtailed growth in the world’s second-largest economy. The debt-laden developer has offloaded a range of assets, including trophy land parcels and stakes in other financial institutions.

China Evergrande confirmed the detentions on Monday but argued it won’t be affected. “The imposition of criminal coercive measures on the relevant personnel of Evergrande Wealth in accordance with the law will not affect the company’s operations,” it said in an exchange filing.

The detentions come as China started a campaign against illegal fundraising to protect consumers. Li Yunze, head of China’s National Administration of Financial Regulation, vowed in a Friday speech to deal with a number of major cases to protect the rights and interest of consumers.

More broadly, Beijing has been engaged in a crackdown on alleged corruption in the nation’s finance industry since 2021, handing out severe penalties, including the death penalty, to top executives.

Evergrande missed payments on 40 billion yuan ($5.6 billion) of wealth management products in 2021, sparking nationwide demonstrations and putting pressure on Beijing to find a solution to avoid further unrest. More than 70,000 people had bought the products, including many Evergrande employees, as the cash-strapped developer tapped them for funding.

The money management arm of Evergrande said Aug. 31 that it couldn’t make payments due on investment products because of a liquidity crunch.

China Evergrande is undergoing the country’s biggest restructuring ever, and the protracted process remains in limbo as key votes on its offshore-debt revamp plan were further delayed to October.

The government has also set up a joint venture to take over China Evergrande’s insurance arm. State-backed Hai Gang Life will run Evergrande Life Assurance Co., according to notices issued by the National Administration of Financial Regulation on Friday.

In Monday’s statement, Evergrande also said it saw “no significant impact” on its current business operations from the sale of Evergrande Life.

–With assistance from Christopher Anstey.

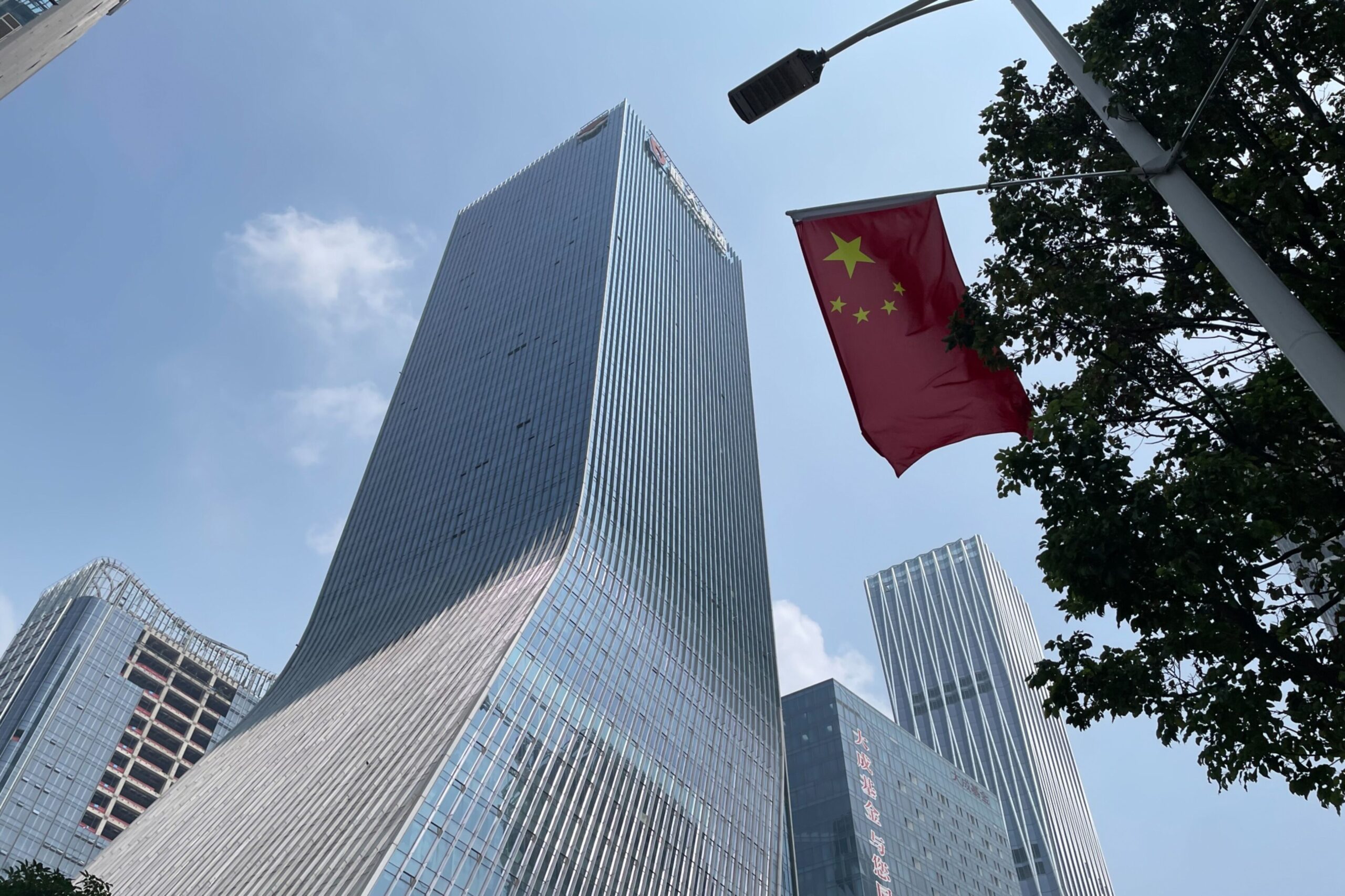

Photograph: The China Evergrande Group headquarters in Shenzhen, China, on Thursday, Sept. 30, 2021. Photo credit: Gilles Sabrie/Bloomberg

Related:

Topics

Law Enforcement

New Markets

Property

China

Was this article valuable?

Here are more articles you may enjoy.

This post was originally published on this site be sure to check out more of their content.